Swiss safe harbor interest rates

Swiss safe harbor interest rates

Circular Letter Framework 2025

On 27 January, the Swiss Federal Tax Administration (SFTA) published the latest Circular Letter updating the applicable safe harbor interest rates for intercompany transactions for the fiscal year 2025 (FY25).

Switzerland (lender) to Related Party (borrower)

The minimum interest rate suggested by the SFTA for loans granted by a Swiss entity to its related parties in Swiss francs (CHF) are as follows:

| Types of loans | Minimum interest rate |

|---|---|

| Loans financed with equity | 1.0% |

| Loans financed with debt (up to CHF 10 million) | Third party cost of debt+ 50 basis points spread (0.5%) (at least 1.0%) |

| Loans financed with debt (exceeding CHF 10 million) | Third party cost of debt+ 25 basis points spread (0.25%) (at least 1.0%) |

This means that the minimum interest rate applicable in calendar year 2024 (i.e. 1.5%) has been lowered which is in line with the inflation rate changes experienced during 2024.

Switzerland (borrower) from Related Party (lender)

The maximum interest rate suggested by the SFTA for loans granted by a related party to a Swiss entity in Swiss francs (CHF) should be calculated using the minimum lending rate in CHF increased by a specific spread, as follows:

| Types of loans | Maximum interest rate | |

|---|---|---|

| Operating loans | ||

| Swiss operating company | CHF 1 million or less | 3.50% (BR + spread) (1% + 2.5% spread) |

| Exceeding CHF 1 million | 1.75% (BR + spread) (1% + 0.75% spread) |

|

| Swiss holding or asset management | CHF 1 million or less | 3.00% (BR + spread) (1% + 2.00% spread) |

| Exceeding CHF 1 million | 1.50% (BR + spread) (1% + 0.50% spread) |

|

This represents a decrease of 25 basis points (0.25%) for 2025 compared to 2024 in all the above categories.

Swiss safe harbor (interest rates)

Switzerland (lender or borrower) to Related Party (borrower or lender)

The minimum/maximum interest rate suggested by the SFTA for loans granted/received which are equity financed in foreign currency are as follows:

| Country | Currency | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|

| EU | Euro | 0.75 | 0.75 | 0.50 | 0.25 | 0.50 | 3.00 | 2.50 | 2.50 |

| US | USD | 3.00 | 3.00 | 2.25 | 1.25 | 2.00 | 3.75 | 4.25 | 4.25 |

| AU | AUD | 3.00 | 3.00 | 1.50 | 1.00 | 1.50 | 4.25 | 4.25 | 4.50 |

| BR | BRL | N.A. | 9.50 | 6.00 | 5.75 | 11.25 | 12.75 | 10.25 | 15.50 |

| CA | CAD | 2.75 | 3.25 | 2.50 | 1.50 | 2.50 | 3.75 | 3.50 | 3.25 |

| CN | CNY | 3.50 | 4.25 | 3.75 | 3.75 | 3.75 | 3.00 | 3.00 | 2.00 |

| DN | DKK | 0.75 | 1.00 | 0.75 | 0.50 | 0.50 | 3.25 | 3.00 | 3.00 |

| UK | GBP | 1.75 | 1.75 | 1.50 | 1.00 | 1.25 | 5.25 | 3.75 | 4.50 |

| HK | HKD | 2.25 | 3.25 | 2.50 | 1.50 | 1.50 | 4.25 | 3.00 | 3.50 |

| IN | INR | N.A. | 7.75 | 7.50 | 6.25 | 6.25 | 7.00 | 7.00 | 7.50 |

| IL | ILS | N.A. | 1.25 | N.A. | N.A. | 1.25 | 3.25 | 3.75 | 4.50 |

| JA | JPY | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 0.50 | 1.25 |

| PL | PLN | 2.75 | 3.00 | 2.50 | 1.50 | 1.50 | 7.00 | 4.75 | 5.50 |

| SW | SEK | 0.75 | 1.00 | 0.75 | 0.75 | 1.00 | 3.25 | 2.75 | 2.75 |

| SG | SGD | 2.25 | 2.75 | 2.25 | 1.25 | 1.50 | 4.00 | 3.00 | 3.25 |

| ZA | ZAR | 7.50 | 8.50 | 7.75 | 5.75 | 6.50 | 8.75 | 8.25 | 8.25 |

| AE | AED | 3.25 | 3.25 | 2.75 | 2.00 | 2.50 | 4.00 | 4.25 | 5.00 |

Switzerland (lender) to Related Party (borrower)

Minimum interest rates for loan receivables:

- For loans in foreign currency financed with external debt, a minimum spread of 0.5% has to be applied as follows:

- (Third party or related party debt financing costs (%) + margin of 0.50% applies (0.25% for the portion of loans above CHF 10 million only)).

Switzerland (borrower) from Related Party (borrower)

- Maximum interest rates for loan payables in principle.

- For loans in foreign currency financed with external debt, a spread shall be added for the maximum interest rate for Swiss entities (2.50% or 2% respective 0.75% or 0.5% for the portion of loans above CHF 1 million.)

Financial markets

Arm's length interest rates

Financial markets are very volatile and sensitive to external shocks; market interest rates change very quickly and often. In the current economic environment, the markets have experienced a significant reduction in interest rates, driven by the monetary policy of major central banks to reduce interest rates, considering that inflation is not a significant problem in the short-term horizon.

However, due to several variables (e.g., US customs regulation changes, elections in several European countries (e.g. France, Germany), and real estate crises in China, among others), we foresee significant volatility in the markets in 2025. In addition, it is important to highlight that the Swiss safe harbor rates are not necessarily arm's length interest rates, which means that even if they are accepted in Switzerland, they may be challenged abroad.<(p>

In a recent Federal Supreme Court case (9C_690/2022 17.07.2024 - Schweizerisches Bundesgericht), it was ruled that if the taxpayer deviates from the application of the safe harbors interest rates, it implicitly rejects its use. This means that in case of a tax audit, the safe harbor rates are not enforced for the tax authorities anymore; hence tax authorities have the right to adjust the interest rates to what they consider are the market interest rates; the adjustment could be made to interest rates that can deviate significantly from the suggested safe harbor rates.

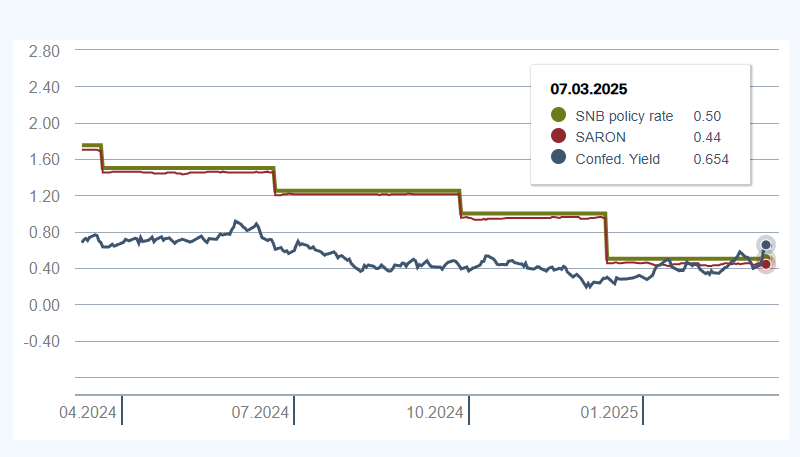

Swiss Confederation bonds yield curve

The graph below shows the yield on Swiss Confederation bonds (spot interest rate for 10-year maturities) in relation to the Swiss National Bank policy rate as well as the SARON (Swiss Average Overnight) rate. To back the above statement of inflation rates lowering over the past periods, the graph clearly depicts this trend.

Source: SNB - Current Interest Rates and exchange rates

Conclusions

Transfer pricing risks

The Swiss safe harbor interest rates are significantly lower than the market (arm's length) interest rates; the use of Swiss safe harbor interest rates when the Swiss entity is the borrower may be challenged by foreign tax authorities because it means that the lender (foreign entity) is lending the money to Switzerland at a rate that may be lower than market rates.

Transfer pricing opportunities

The Swiss tax authorities will accept a deviation from the Swiss safe harbor rates if the taxpayer can demonstrate that the interest rate applied is an arm's length interest rate based on the following:

- Borrower's credit rating (CR).

- Benchmark analysis based on the CR and the loan terms and conditions.

Higher interest rates supported by a transfer pricing analysis allow Swiss entities to charge more interest to their related parties, and if the related party is located in a jurisdiction with a higher tax rate than Switzerland, it will generate tax savings for the Group.