Climate scenario analysis as a competitive edge

Climate scenario analysis as a competitive edge

Regulatory developments and changes in climate policy are posing new challenges for companies. Analysing climate scenarios can help them highlight risks, identify opportunities and act strategically. In this way, companies can strengthen their resilience and create the basis for sustainable success.

Climate risks: Legal frameworks as drivers of innovation

Climate risks are increasingly recognised as a strategically significant factor. New regulatory requirements – such as the Swiss Climate and Innovation Act – set the conditions for achieving net-zero targets by 2050. In addition, the Climate Protection Ordinance requires companies to have concrete transformation plans with credible emission reduction strategies and comprehensive risk assessments.

European Sustainability Reporting Standards (ESRS)

At the European level, the European Sustainability Reporting Standards (ESRS) require companies to disclose climate-related risks and opportunities and carry out scenario analysis.

The good news is that such guidelines can be a catalyst for innovation. Companies that integrate climate scenarios into their corporate strategy can turn regulatory challenges into opportunities to identify market trends and strengthen their competitiveness. This approach not only ensures compliance with legal requirements, but also promotes a future-focused mindset and decisive action.

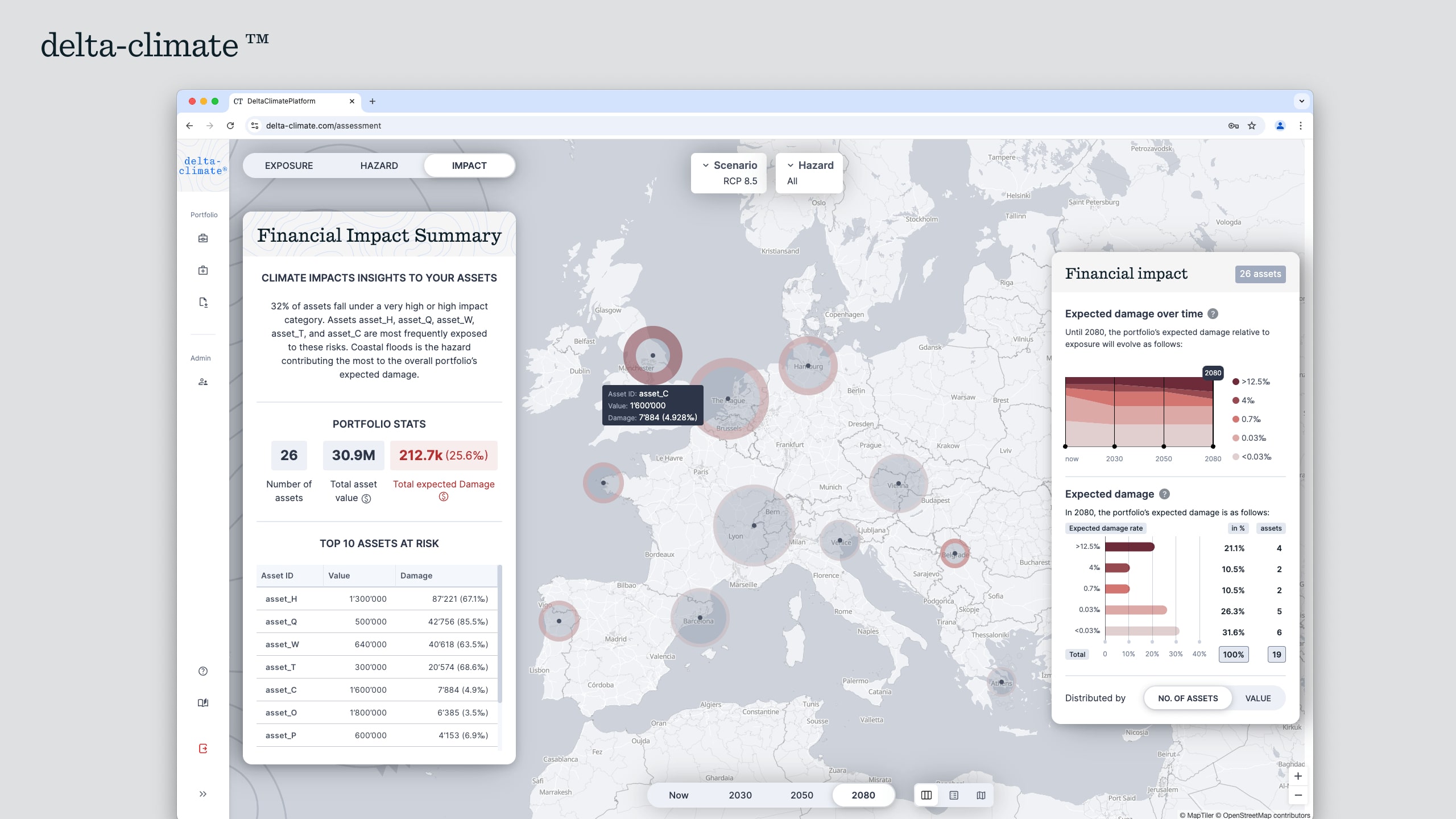

Managing physical climate risks – building specific resilience

Holistic management of physical climate-related risks and opportunities requires an integrated, multidisciplinary approach that combines scientific expertise with advanced data analysis. Together with CLIMADA Technologies, BDO provides precise and scientifically validated assessments of physical climate risks. The delta-climateTM platform links a variety of data sets, including climate projections, historical weather data, satellite images and ground-based observations. This enables climate indicators such as extreme heat or precipitation to be modelled at a local level and the frequency and intensity of extreme weather events such as floods or storms to be analysed.

The platform can simulate global and regional climate scenarios and link them to specific company data in order to determine sectoral exposure, from financial institutions and asset managers to manufacturing and consumer goods companies. By using advanced statistical methods such as scenario analysis and probabilistic risk assessments, we help organisations to quantify uncertainties and identify particularly exposed areas. This makes it easier to understand both the direct physical impacts and the cascading effects for supply chains and infrastructure.

Managing transitory risks – shaping business models for the future

It is not only extreme weather events that pose risks. The transition to a climate-friendly and low-emission economy also presents companies with challenges – due to regulatory changes, technological innovations, changing market requirements and social pressure.

BDO supports you in systematically analysing and evaluating these transition risks and integrating them into your strategy. This helps you to identify risks at an early stage, actively manage them and at the same time tap into potential, for example by investing in new technologies, targeting climate-friendly market segments or developing climate-resilient products and services.

Case study: portfolio resilience using climate data

A leading European tourism company with over 60 locations in Europe uses delta-climateTM to identify which of its sites could be particularly affected by heatwaves, lack of snow or heavy rainfall in the future. The findings flowed directly into investment and divestment decisions – and made the company resilient to climate change.

Insurance companies are also adapting their risk models to the increasing frequency and intensity of extreme weather events, while financial institutions are reassessing the risk profiles of mortgage portfolios under changing climatic conditions.

Resilience through risk analysis: acting strategically instead of reacting

Climate issues are becoming increasingly central to corporate decision-making. Whereas in the past the focus was mainly on operational risks and CO₂ offsetting, today climate-related challenges go far beyond that.

New scientific findings and growing regulatory requirements have highlighted the financial impact of physical and transitory climate risks, emphasising the need for more comprehensive risk management.

Analysing climate risk in depth and translating this into entrepreneurial action not only strengthens resilience, but also helps identify new market opportunities.

Contact us for an initial consultation and find out how you can make your company sustainable and future-proof.